Claims process for the final Self-Employed Income Support Scheme grant will open next month

This grant will cover the five-month period 1 May 2021 to 30 September 2021.

To be eligible for the grant you must be self-employed, either a sole trader or member of a partnership.

Conditions to qualify for this grant:

- You must have traded in the tax year 2019-20 and submitted your tax return for that year on or before 2 March 2021 and traded in the tax year 2020-21.

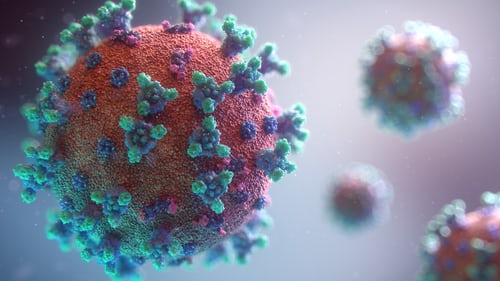

- You must either be currently trading but impacted by reduced demand due to COVID or have been trading but are presently unable to do so due to COVID restrictions.

- To be eligible to claim HMRC will check previous years tax returns to see if your trading profits are no more than £50,000 and at least equal to your non-trading income.

- When claiming you must declare that you will continue to trade and that you reasonably believe that your business activity will be reduced in the period 1 May to 30 September 2021.

The 5th grant is different:

The 5th grant will be determined by how much your turnover has been reduced in the year April 2020 to April 2021.

- If the turnover reduction is 30% or more, you can claim 80% of 3 months’ average trading profits up to a maximum £7,500.

- If the turnover reduction is less than 30%, you can claim 30% of 3 months’ average trading profits up to a maximum £2,850.

HMRC have said they will provide more information by the end of June to help you work out how your turnover will be affected.

When can you claim:

HMRC will contact you mid-July to give you a date to make your claim.

Pick up the phone, we are here to help.